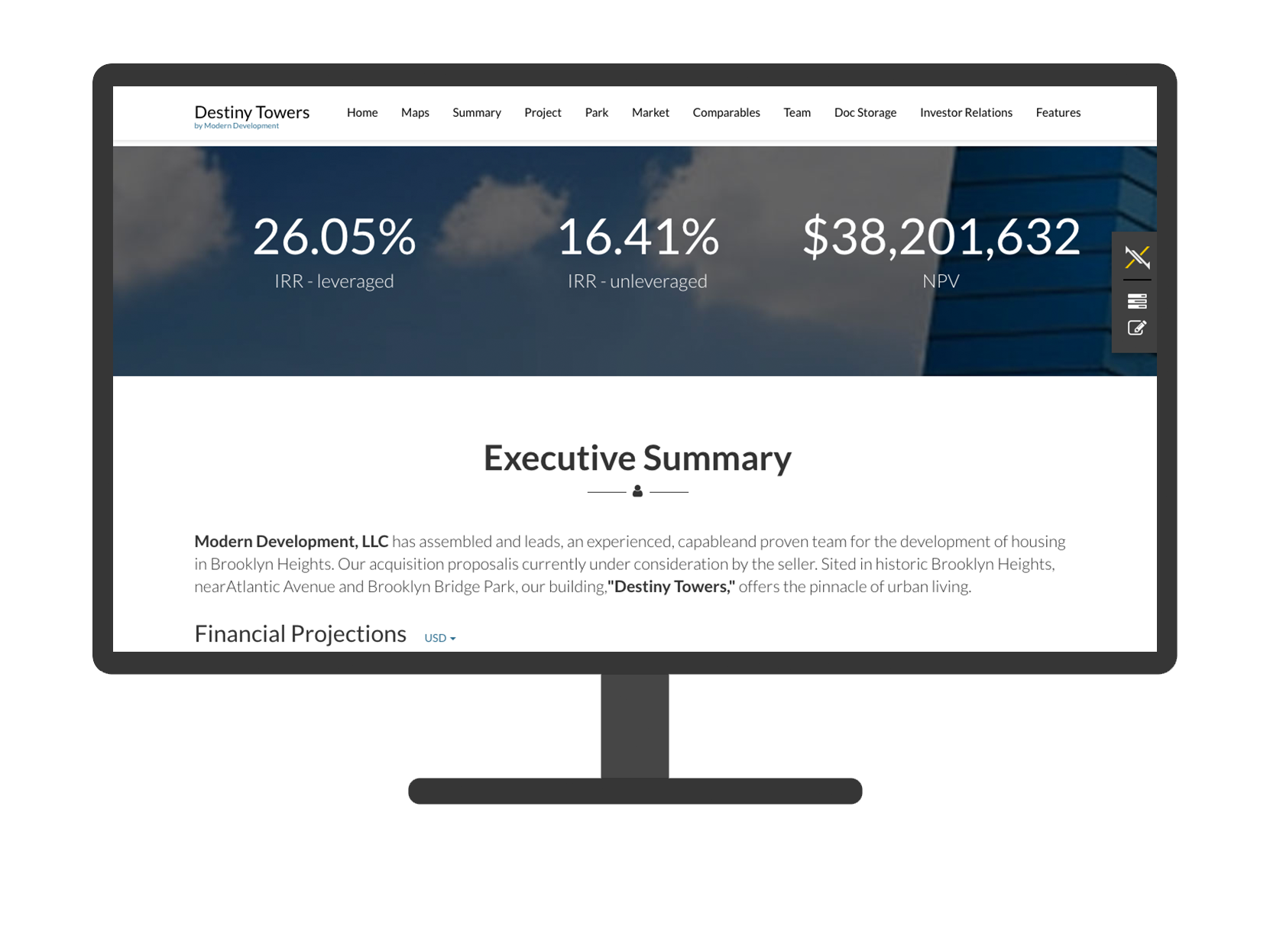

Build a living Digital Deal Book instead of static brochure. Continuously update your offering as new information becomes available. Integrate digital media, videos, PDFs, 3rd-party content, financial statements, and news articles manually or through our API.

Quickly and easily assemble all of the materials necessary to explain the unique value proposition of your company. Jump start the process with industry specific templates which include minimum requirements and best practices.

All content can be classified as public or as private. Access to confidential information can be granted in advance or at the request of a visitor. Confidentiality / Non-Disclosure agreements can be required upon request and digitally stored on the platform.. Visitor requests generate an email notification for hassle free approval. Access to confidential content requires a login which allows the tracking of visitor activity including what content was viewed and downloaded. Visitor access can be revoked at anytime. To defend against cyber attacks, StageXchange does not store any sensitive information on it's own servers. Content is securely stored using Amazon Web Services. Clients have the option to integrate with 3rd-party data rooms (Intralinks, Merril Data, Dropbox).

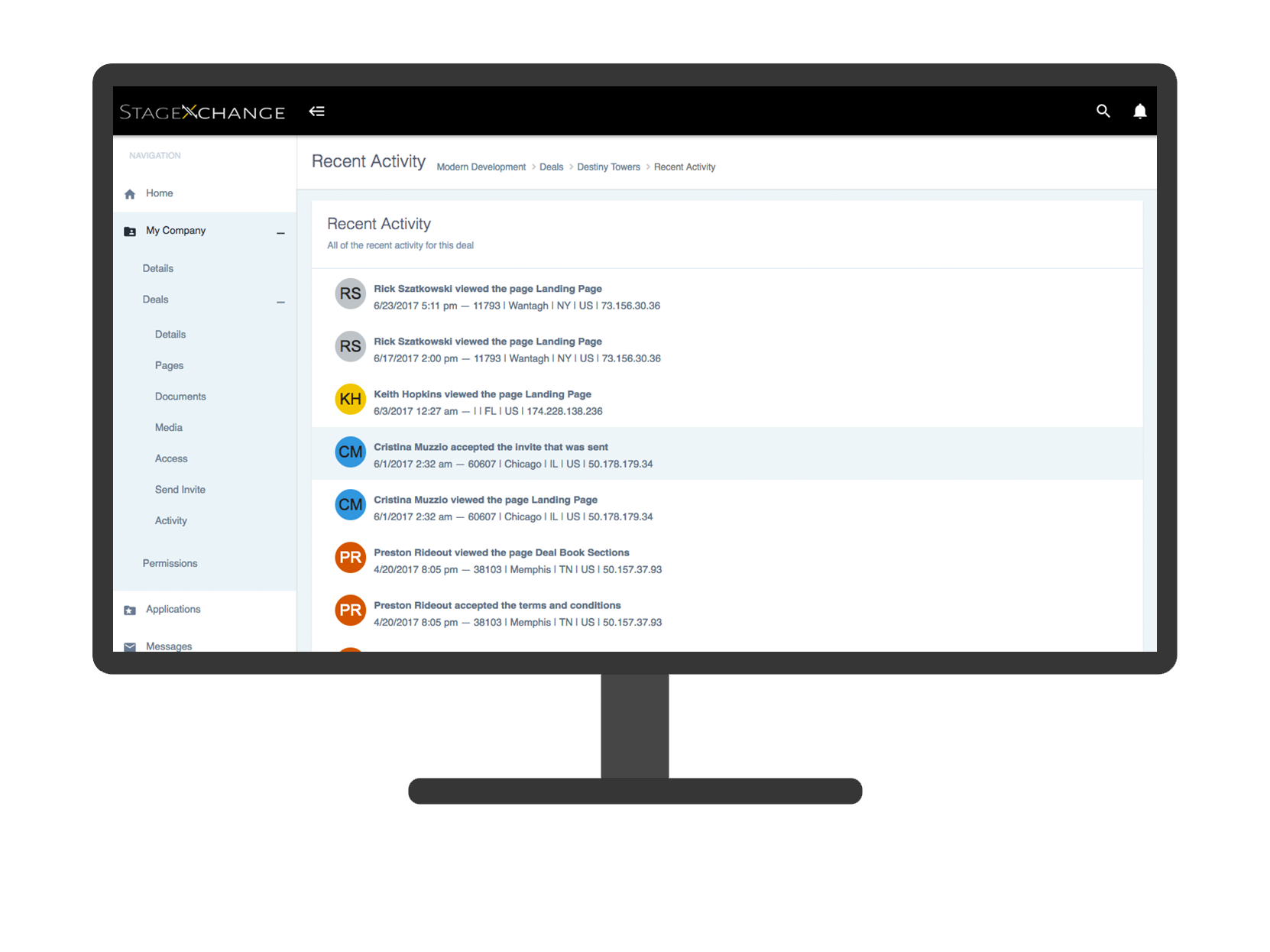

Guage investors interest by tracking prospective investor's behaviors. Gain immediate insight into their level of interest. Quantify how often and how long an investor is engaging with your content. Use this information to learn if your opportunity is resonating with your prospective investors. Business intelligence provided by the platform can help you decide when you need to reach out to prospects or modify your message.

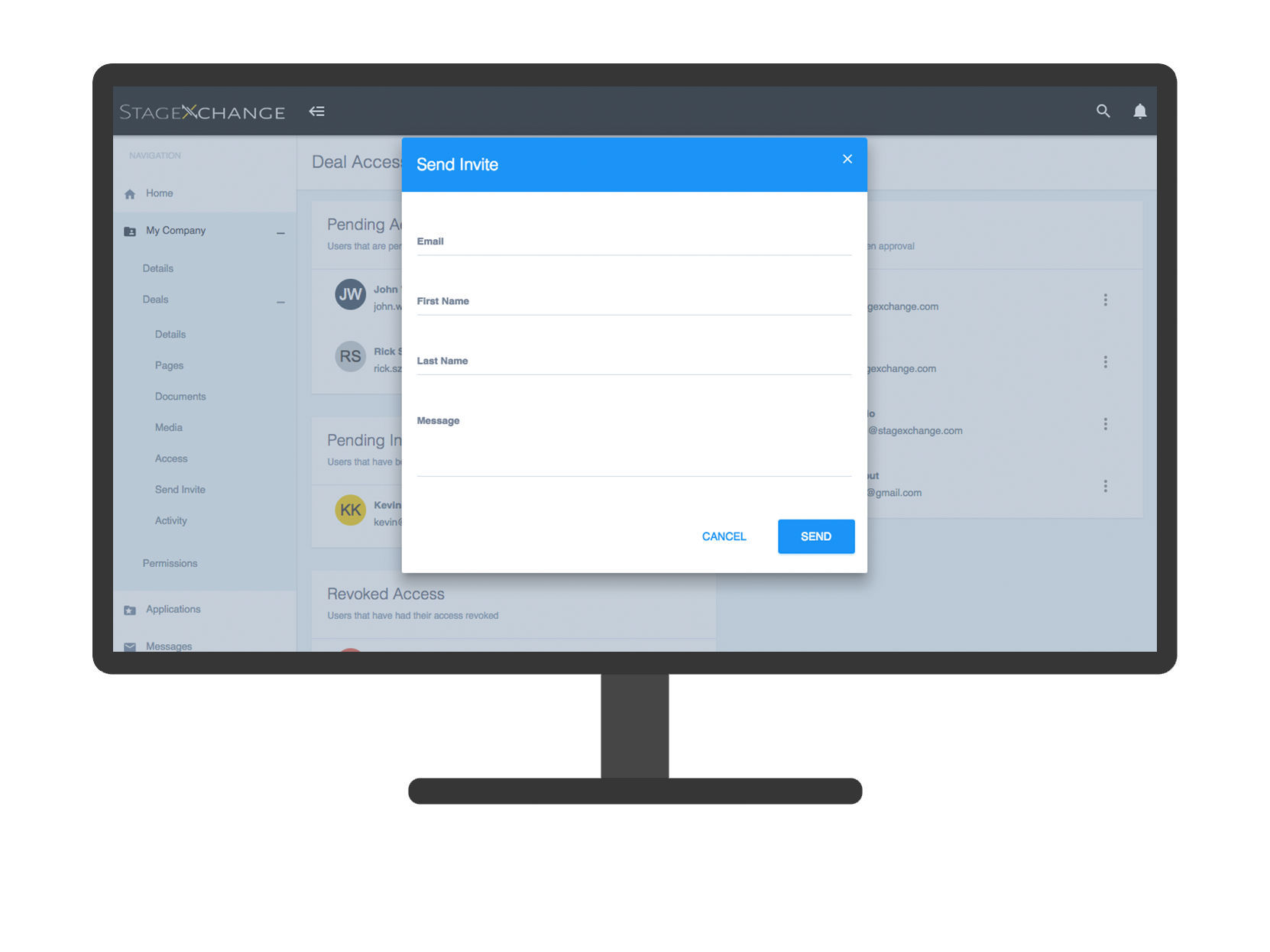

Marketing your deal to individuals that you've already established trust with just got easier. Invite your network to review your deal with customizable email invitations. Quickly stand up your deal, highlight the opportunity, the risk and the reward. Provide access to all critical documentation.

Utilizing the StageXchange Digital Deal Book, create a institutional grade investment offering. Anticipate investor concerns in advance and address them without overwhelming them with too much information. In a nutshell give investors what they want. Apply to a private marketplace to give your opportunity to the Stage investment community.

Keeping your investors informed of the progress of your venture is paramount. Dedicated investor relations sections make it easy to share your current financials. Financial statements can be embedded as PDFs, attached as downloadable documents, or digitally imported via API.

Here at StageXchange we believe in easing the process of deal management. From extensive due diligence to transparent pro formas, we ensure end-to-end institutional grade quality. Our unique digital deal books make it easy for developers to share their deal vision with potential investors.