About Trivium Strategic Capital

Trivium Strategic Capital is an international asset management firm that increases private portfolio returns for its high net worth and institutional investors. Founded in 2015, the privately-held Texas firm is led by industry veteran Jonathan Patton.

The Problem

Trivium Strategic Capital is a private placement firm that develops a few deals each year in collaboration with a select group of investors. The company required a solution that could reduce the amount of time involved in raising funds. A combination of Dropbox and Intralinks had been used previously due to their document management capabilities. While their previous software provided a usable space for collaboration and the necessary encryption of deal data, these tools were insufficient in expediting due diligence.

Time was a critical factor for Trivium. While they enjoyed Intralinks collaboration portal and its ability to maintain document integrity, it still forced investors to toggle between various applications and sources to find what they needed to validate deal assumptions. They wanted a single solution for deal management that wouldn’t require them to reinvent the wheel with each new deal and could provide investors with an intuitive space for efficient due diligence. Moreover, they needed a more aesthetically-pleasing way of pitching deals that could also serve the unique value the opportunities provided.

Solution

StageXchange was designed to make the world of private equity investment easier by vastly improving the due diligence process through information management and its presentation tool called the Deal Book. Its web-based platform provided a secure and highly customizable solution that enables dealmakers and investors to create standardization and reduce risk.

Benefits

- Reduces Time –Everyone’s time is valuable; there are only so many hours in any given day. It is critically important to deal teams to reduce the amount of time and effort on the part of investors in order to make it easier for them to say –yes- to the opportunity. StageXchange helps speed up the process of evaluation and due diligence in various ways

- Drastically minimizes upload times of key data

- Elegant and easy-to-use interface that enables users to quickly locate the information they need

- Standardization of formatting

- User-friendly mobile interface

- Living Deal Books

- Integrated checklists

- Messaging and collaboration features

- Eliminate IT Resources - StageXchange was meant to simplify life for its users and put the control back into the hands of deal teams and investors. It was important for us to be able to provide investors with a single, unified system where usable data could easily be obtained and no time was lost toggling back and forth between Excel spreadsheets and document management software. With open APIs and simple admin features, our platform makes it possible for dealmakers to control how they present and manage deal information without requiring any additional IT resources. Pitch data, elegant visualizations, analysis tools, and 3rd-party validation all within the same platform reduces waste and makes it easier for investment teams to quickly evaluate opportunities.

- Information Management and Scalability – The sheer amount of data generated around any PE transaction can be overwhelming. Our Deal Books are scalable, customizable, searchable and easily customized to meet the needs of a wide variety of investment opportunities. Flexible architecture allows the platform to meet the needs of the business throughout the entire life cycle of a deal. With investment horizons on acquisitions that can exceed 40 years, flexibility is critical. There is no limit to the content contained or number of sections in a Deal Book. Users can add or delete sections as needed with the click of button and there is no limit to the amount of data that can be stored on the platform.

- Risk Reduction – The most important part of any deal is the ability to reduce its risk. Our platform offers the ability to demonstrate a deal’s value while also reducing its risk through transparency, 3rd party validation, analysis tools and standardization of key metrics. With risk reduced it makes it easier for investors to say “yes” to the deal.

Value Analysis

"Before StageX, we struggled to organize data rooms on Dropbox to make them both engaging and informative. StageX made that not only possible but easy! It was absolutely critical to our success in the raise. We even had investors ask us more details about the platform so they could integrate into their businesses."

Torey Tipton, Director of Investor and Market Relations

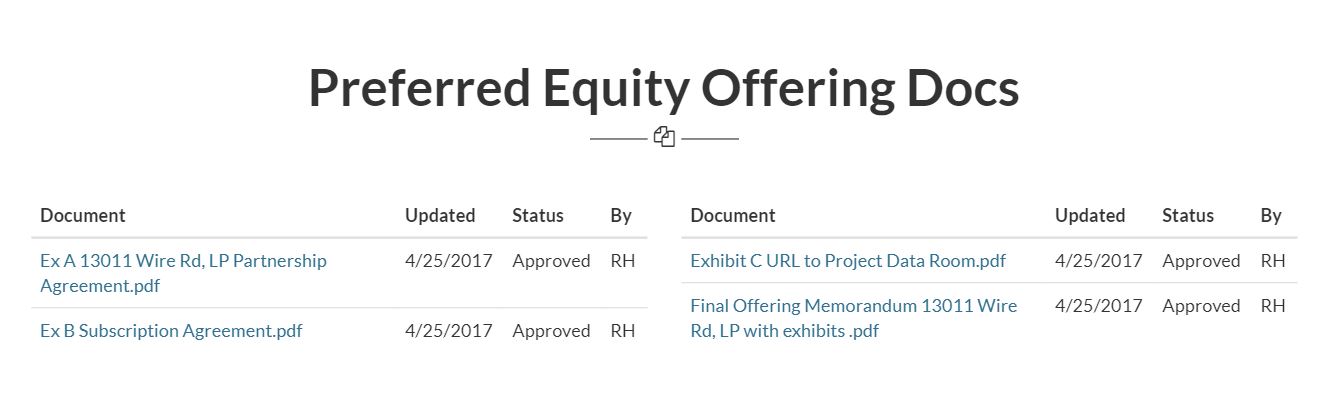

Trivium Capital used StageXchange to raise funds for a project in Leander, Texas. Normally, the fundraising period takes between 30-40 days to raise capital. After employing StageXchange, Trivium raised $1.2 million dollars in just a few days after opening the offering. The company’s use of the platform made it easy for investors to pull the trigger and they found that they had more investor interest than was even needed for the project.

Trivium shared the dealbooks individually with investors and held a small group meeting to pitch the deal. Leadership said that it was easy to present using StageXchange and their team found it likewise easy to upload and configure the deal data. According to feedback from the investor pool, the platform’s analytical tools, 3rd party validation, and data transparency made it easier for investors to find what they needed.

StageXChange is the only Deal Software on the market today that not only gathers the entirety of due diligence information required for an investment. It is a platform that provides supporting documents and data with 3rd party verification so that investors can see the value in opportunities, compare markets, and proceed with confidence. Not only does the platform allow clients like Trivium to quickly put together deals and pitch them to investors, but it provides project teams with tools they need to manage, share, and develop those opportunities in the same application.